Managing your employee’s time and overtime is essential for a business owner. It is an overhead cost that could be expensive if not managed effectively. Also, if you are paying overtime continually it may be time to make changes such as hiring additional staff.

What Does Working Overtime Mean?

The definition of overtime is working time in excess of a standard day or week. The Fair Labor Standards Act (FLSA) requires employers to pay one and one-half times the regular rate for all hours worked over 40 hours in a workweek. They do not require premium pay for daily overtime or when an employee works on a weekend or holiday.

But, some states such as California have stricter guidelines for overtime. Some states have daily laws for working over eight hours a day. Some states have laws for working over ten or twelve hours a day.

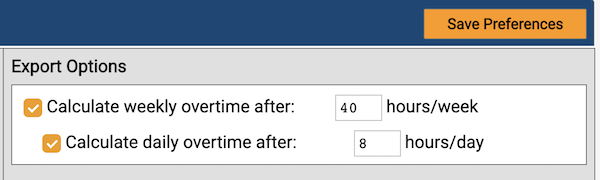

It is important to know your state laws and local laws when you start hiring employees. You can also use software like ezClocker where it will automatically calculate overtime based on hours you specified:

How Do you Calculate Overtime?

Unless an employee is exempt, overtime is calculated at a rate not less than time and one-half their regular rate of pay. The new Department of Labor rules that went into effect on January 1, 2020, also requires you to pay overtime to anyone who makes under $684 a week regardless of their job title. That is $33,568 per year.

Overtime pay is calculated by overtime hours worked x hourly rate of pay x 1.5.

For example, let’s say your hourly (or non-exempt) employee works 50 hours a week for $10 an hour, how do you calculate their weekly overtime?

Regular pay: 40 hours x $10 per hour = $400

Overtime pay: 10 hours x ($10 per hour x 1.5) = $150

40 hours would be paid at $10 an hour

10 hours would be paid at $15 an hour

If your state has different overtime laws, you would calculate it that same way using the specified hours required by law.

Salaried employees may qualify for overtime. You would use the same method when calculating using their hourly rate.

Who is Exempt from Overtime Pay?

As stated above, the new rules require you to pay overtime to anyone who makes under $684 a week regardless of job title. A salary status does not mean they are exempt. There are five categories in which an employee could be exempt. They are executive, administrative, professional, computer, or outside sales. Each of these has a duties test so you may determine whether they should be paid overtime.

If you are unsure of an employee’s exempt status after reviewing the duties tests, you may want to consult with an employment law attorney.

Also, according to the FLSA, the exemptions do not apply to manual labor workers who perform work involving repetitive operations with their hands, physical skill, or energy. For example, this could include carpenters, electricians, mechanics, etc. The exempt status also does not apply to first responders such as police or firefighters.

Again, employers must comply with any federal, state or local laws, regulations, or ordinances establishing a higher minimum wage or lower maximum workweek than those established under the FLSA.

Why Do Employees Work Overtime?

Some reasons for the increase in hours could be because of increased workload or staffing issues. Also, it could be because of new projects with tight deadlines. For example, when a new construction job is due, workers may be working more hours to complete the project.

According to the Society of Human Resource Management (SHRM), there are several situations where overtime can be good.

Overtime can:

- Be a good solution for 24/7 coverage

- Allow employers to quickly respond to short-term solutions for increased workload or staffing issues

- Improve the company’s competitive position in the local area because many employees like the extra income

- Be less costly than hiring and training a new employee

It is great for short-term solutions but if it is used too long, an employee may become burned out.

It is important to understand the negative effects of employees working too many hours. You want to ensure a work-life balance for your employees so you don’t lose them.

How Can You Prevent Overtime?

Paying for overtime continually can be costly for a small business. Preventing it can be easy if you have accurate timekeeping records to watch your employee’s hours. You should also understand why they are working extra hours.

Watching Overtime

It is important that you keep an eye on individual and overall hours. Also, if someone misses work after working many hours, that may be an issue.

You should research and study why it keeps occurring if you don’t know the reasons. Is it due to frequent absenteeism in the department? Could it be because a short-term project has become long-term? If that is the case, could you hire seasonal workers to help? Maybe they could help with easier tasks.

Identify your reasons and determine whether you may need to come up with better solutions. If your business is booming and you are having problems keeping up, consider hiring more workers. Also, talk to your employees who are working overtime frequently. Are they burning out? What would they suggest for a long-term solution?

Write Good Job Descriptions

It is important that job titles, job duties, and the impact that position has on the company determine whether certain positions are exempt. This is why good job descriptions are important.

A really good job description can help you with the duties test to determine exempt status as mentioned above. It can also help you hold employees accountable. Additionally, if they are doing other job duties not in the description, does it need to be added or does another job need to be created? When analyzing a position that requires a lot of overtime, use the job description to ascertain whether it fits that job.

Track Your Employees Time

It is important to keep accurate timekeeping records on your employees. There are several cases where employers did not keep accurate records. When an employer doesn’t keep adequate records required by law, the employee can show their own proof. If you aren’t keeping good records, then you may end up paying backpay later.

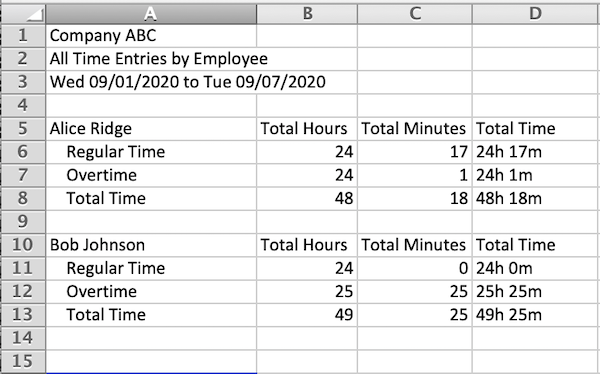

Consider investing in a time tracking app for your small business like ezClocker. It keeps track of your employees’ hours, schedules so your employees don’t exceed their hours, and reports any overtime when it’s time to run payroll. An example of what a report would look like when using ezClocker:

Review Your Employee’s Time Often

In summary, consider whether overtime is necessary for your small business. Make sure you also budget for those extra hours since there may be an issue that crops up every once in a while. Review your employee’s time and keep an eye out for any increases of time in which you are not aware. Conduct research to ensure some employees aren’t staying longer than they should just to get the pay. Sometimes, overtime is crucial for short-term solutions. If you need it for longer terms, consider hiring seasonal, temporary, or new employees. Some workers love working a lot of hours, and some don’t like it all. You want to prevent burnout, turnover, and absenteeism. Furthermore, by talking to your employees, you can find why they are working so much overtime and their thoughts about it.

15 comments