Many small business owners think they know how to calculate labor costs. At first, most start with hourly pay times hours worked. In practice, to calculate labor costs accurately in 2026, you must look past wages and track what really drives spending.

At the same time, labor costs affect pricing, staffing, and growth. When numbers feel off, profit often shrinks. In many situations, the issue is not sales. It is a labor cost blind spot.

With that in mind, this guide explains how to calculate labor costs the right way. It walks through hidden expenses, real world examples, and a practical calculator template you can use right away.

What Labor Costs Really Mean for Small Businesses

To begin with, labor cost means more than paychecks. Also, it includes every dollar spent to keep workers on the job. In short, wages are only the starting point. True labor cost includes payroll taxes, benefits, overtime premiums, and lost time. In many cases, it includes errors and delays that do not show up on reports.

At the same time, labor costs shape daily decisions. Staffing levels, schedules, and pricing all depend on them. When you calculate labor costs with missing data, those decisions suffer. For example, a business may seem profitable. Yet, once hidden costs are added, margins disappear. In many cases, this happens often in hourly teams with overtime or manual tracking.

The takeaway here is clear. To calculate labor costs correctly, you need a full view. In other words, that full view starts with wages and grows from there.

The Basic Formula and Why It Falls Short

Most guides start with a simple formula. On the surface, hourly wage times hours worked equals labor cost. In fact, that formula works only on paper.

In practice, the simple formula leaves out major factors such as it:

- Ignores payroll taxes

- Skips overtime premiums

- Misses benefits and paid time off

Over time, these gaps add up.

For instance, two workers may earn the same wage. One works steady hours. The other racks up overtime. As a result, their true labor costs differ greatly. In other words, the basic formula explains pay. It does not explain the cost.

To calculate labor costs that match reality, the formula must expand. From there, each added layer shows where money really goes.

Direct Labor Costs You Must Count

At first glance, direct labor costs are the easiest to see. Even so, they still need care.

To begin with, these costs include hourly wages, salaries, and shift premiums. Overtime pay belongs here as well. In many situations, overtime creates the largest jump in cost.

According to the US Department of Labor overtime guidance, nonexempt employees earn time and one half for extra hours. That premium alone can raise labor costs fast.

Payroll taxes also fall under direct costs. Employers pay Social Security, Medicare, and unemployment taxes. The IRS employer tax guide outlines these obligations in detail.

Now consider paid time off. Vacation, sick time, and holidays count as paid hours without output. As a result, when that happens, the cost rises while work pauses. At this point, many owners stop. Yet, stopping here still understates real labor cost.

Need an Employee Time Tracking App?

Indirect Labor Costs That Are Often Missed

In many cases, indirect costs hide in daily routines. Still, they drain profit. For example, one major factor is time theft. Late clock ins, early clock outs, and long breaks add up. In some cases, minutes turn into hours by week end.

At the same time, payroll errors add another layer. Manual entry mistakes lead to overpay or rework. Fixing those errors takes admin time.

Also, training time is another indirect cost. New hires need hours of paid learning before they produce. At the same time, there are other labor costs, such as benefits, that you should also consider. Productivity loss also matters. When schedules shift or teams lack clarity, output slows. Over time, that loss raises the true cost per hour.

To calculate labor costs correctly, these indirect factors must be estimated and tracked.

Overtime Premiums and Scheduling Impact

Overtime deserves special focus. It is legal, and it is sometimes needed. Still, it is costly. Overtime increases wages by fifty percent for each extra hour. In practice, that jump affects taxes and benefits tied to pay.

In many situations, overtime appears cheaper than hiring. Yet, long term use tells a different story. Fatigue rises, errors increase, and turnover risk grows. When that happens, and workers’ schedules are not clear, overtime sneaks in. When tracking is manual, it often goes unnoticed until payroll closes.

The takeaway here is simple. Overtime must be tracked daily, not guessed later.

Benefits Burden and the Real Cost of Perks

At first glance, benefits feel optional. In reality, they are core labor costs. Health insurance, retirement matches, and paid leave all carry dollar values. Even small benefits add up over a year.

Benefits cost research shows that benefits often equal thirty percent or more of wages. For some roles, that share is higher. In addition, benefits costs rise even when hours stay flat. Premiums increase, coverage expands, and compliance changes.

To calculate labor costs fully, benefits must be spread across hours worked. In turn, this creates a true hourly cost that reflects reality.

Payroll Errors and Admin Time

Payroll rarely runs itself. Someone must review hours, fix errors, and process pay. In many cases, manual systems increase this burden. Each correction takes time. Each delay costs focus. In turn, admin labor becomes its own labor That time could serve customers or plan growth.

One ezClocker case study on payroll accuracy shows how time tracking clarity reduced corrections. Sandro DeSouza, from Eagle Vision Construction, found that he was able to eliminate clock-in discrepancies quickly and efficiently handle payroll and scheduling. Before Sandro came on board, employees would write their hours down on paper and text each other in a group chat for scheduling. As a result, this provided a lot of inefficiency.

At the same time, compliance risk drops when records are clean. That saves stress and potential penalties.

Productivity Loss and Hidden Labor Waste

Not all labor hours produce value. Also, waiting time, idle time, and unclear tasks reduce output. At the same time, workers are paid while work stalls. In many cases, the issue is not effort. It is a lack of visibility.

A case study of MDX Medical Center revealed that employees were sometimes clocking in while on their way to the office, rather than upon arrival. Utilizing ezClocker’s GPS and time tracking revealed this gap, allowing the manager to stop unnecessary, costly time additions.

Another case study is at Gecko Solutions, owner Allan Dalangin used job coding and GPS verification to compare scheduled cleaning times with actual hours worked. The data showed that crews were finishing jobs much earlier than scheduled yet receiving full pay. This allowed the company to restructure its scheduling to improve efficiency. For example, Allan had billed one site as a four-hour job for one person. ezClocker showed that employees often left early, even though Allan was still paying them for the full four hours. So, Allan put two people on the job for one hour. The move saved him a chunk of money each month.

From there, once seen, managers adjusted tasks and reduced waste.

Productivity loss is hard to price. Still, rough estimates help. Even a ten percent loss raises the true labor cost per unit.

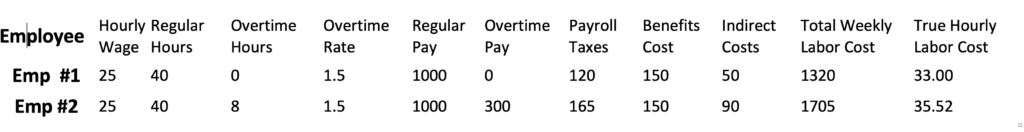

Labor Cost Calculator Template

At this point, it helps to put numbers together.

With that in mind, below is a simple labor cost calculator template.

Table structure:

- Employee role

- Hourly wage

- Average hours per week

- Overtime hours per week

- Overtime premium cost

- Payroll tax rate percent

- Benefits cost per week

- Estimated indirect cost per week

- Total weekly labor cost

- True hourly labor cost

Step by step method:

- To begin with, multiply the hourly wage by regular hours.

- Next, calculate overtime pay using the premium rate.

- Now, add payroll taxes using the IRS employer rate guidance.

- Then, add the weekly benefits cost.

- After that, estimate indirect costs like admin time or lost hours.

- From there, add all weekly costs together.

- Finally, divide the total weekly cost by the total hours paid.

In short, this gives a true hourly cost that reflects reality.

Here is an example:

How Labor Costs Affect Pricing and Profit Margins

At this point, labor cost data becomes useful only when it guides decisions. For example, one of the clearest uses is pricing. In many cases, when labor costs are underestimated, prices are set too low. When that happens, profit shrinks even when sales rise. In many situations, owners blame demand when the real issue is labor math.

For example, a service priced at one hundred dollars may seem profitable. Yet, once true labor cost is applied, the margin may fall below target. In fact, this gap often surprises owners.

In the same way, product based businesses face similar risks. Assembly time, packing time, and admin time all count as labor. When these hours are ignored, over time, pricing loses accuracy.

Now consider seasonal work. For instance, labor hours often rise during busy periods. Without updated cost tracking, pricing stays flat while labor climbs.

The takeaway here is simple. When you calculate labor costs fully, pricing becomes grounded. Then, profit targets feel reachable, and decisions feel calmer.

Comparing Overtime Versus Hiring Decisions

Often, many owners face a common choice. Should they pay overtime or hire another worker? At first glance, overtime feels easier. No training, onboarding, or added headcount. Still, in many cases, the cost tells a deeper story.

In practice, overtime pay increases hourly wages. Taxes rise with pay, fatigue may slow work, and errors may increase. Over time, these effects raise the cost per unit.

At the same time, hiring brings new expenses. Training time counts as labor. Benefits may apply. Yet, steady hours often reduce overtime reliance. In some cases, hiring lowers total labor cost even with added headcount. This outcome surprises many teams.

Using the calculator template helps compare both options. One column shows overtime cost. Another shows the entire cost of a worker. The difference becomes clear. Is it cheaper for you to pay overtime or hire a new person? With that in mind, decisions move from gut feeling to numbers. This shift reduces stress and improves planning.

Labor Costs and Turnover Risk

In many cases, turnover affects labor costs more than most owners expect. Also, when a worker leaves, costs do not stop. Recruiting time counts as labor. Training hours count as labor. Also, lost output counts as labor.

At the same time, overtime often rises during gaps.

In many situations, turnover creates a cycle. Higher costs lead to stress. Then, stress leads to more exits. The cost of replacing an individual employee can range from one-half to two times the employee’s annual salary. For instance, fifty-two percent of voluntarily exiting employees say their manager or company could have done something to prevent them from leaving their job.

With that in mind, tracking labor costs over time helps spot this pattern early. Rising overtime paired with rising errors may signal burnout. Now, when leaders see this data, they can act. Once schedules adjust, roles shift, and support increases.

In turn, labor cost stability improves.

Using Labor Cost Data for Forecasting

Forecasting depends on reliable inputs. At the same time, labor is one of the highest costs of a business. When costs are guessed, forecasts fail. When costs are tracked, forecasts guide action.

For example, a business planning for growth needs to know the labor impact. Each new client adds hours. Each new hour adds cost. Using past labor data helps predict future needs. Average hours per job, average overtime rates, and average indirect costs.

At this point, the calculator becomes a planning tool. You can model best case and worst case scenarios. Now, staffing plans align with reality. Cash flow planning improves, and hiring decisions feel safer. The takeaway here is that labor cost data supports long term thinking, not just payroll.

Many teams review labor costs monthly. This habit feels efficient. Yet, problems grow quickly within weeks. Also, the weekly review catches issues early. Overtime spikes show fast, and scheduling gaps stand out.

This habit does not require complex systems. It requires consistent tracking and attention.

Labor Costs and Compliance Risk

In practice, compliance issues often tie back to labor tracking. For instance, missed overtime rules lead to back pay. Incorrect records raise audit risk. Poor documentation causes stress. The US Department of Labor outlines record keeping requirements clearly. Also, accurate time records protect both workers and employers.

IRS payroll guidance also stresses correct reporting. Errors here carry penalties.

When labor costs are tracked accurately, compliance becomes easier. Records are ready, and audits feel less intimidating. In many situations, compliance risk costs more than wages. Avoiding it protects the business.

Labor cost tracking affects people, not just numbers. When hours are clear, workers trust pay. When pay is fair, morale improves. At the same time, managers trust data. Conversations shift from blame to facts.

Also, trust and transparency show how clear tracking reduced disputes. Time inflation happens when people stretch their hours by mistake or on purpose. For instance, a worker may forget to clock out. They may arrive early and clock in before starting work. They may stay on the clock after work slows. These situations create payroll issues. At the same time, they can harm team trust.

Using a time tracking system like ezClocker will protect the team and the business.

Preparing Labor Cost Data for Stakeholders

In many situations, labor cost clarity helps beyond operations. Accountants use it for tax planning. Advisors use it for growth plans. Lenders use it to assess stability. When numbers are clear, you can make better decisions. Also, using a standard worksheet or table helps communicate this data. Stakeholders see the same view.

As a result, once you calculate labor costs correctly, decisions improve. Pricing becomes clearer, staffing plans feel safer, and budgets match reality.

For example, knowing the true hourly cost helps set project prices. It also helps compare overtime versus hiring.

In many situations, this insight prevents costly mistakes.

Final Thoughts on the True Cost of Labor

To calculate labor costs in 2026, you must look beyond wages. In other words, true cost includes pay, taxes, benefits, overtime, errors, and lost time. With that in mind, this guide gave you a clear method and a usable template. With that in hand, you can see where money goes.

If you want, review your numbers monthly. Also, small checks now prevent big surprises later. To calculate labor costs correctly, you must move past wages alone. True cost includes time, taxes, benefits, errors, and lost output.

Over time, labor cost awareness becomes a strength. Then, decisions improve, and growth seems manageable.