Payroll errors time tracking problems can quietly drain a company’s profits and morale. It becomes difficult to know if the hours reported are correct when time sheets are handwritten. Late punches, unrecorded breaks, and small rounding mistakes can add up to hundreds of dollars each month. Overall, these issues do not happen because managers are careless. They happen because paper systems and memory are unreliable.

Accurate time tracking gives small businesses a way to protect both the company and its staff. It ensures fair pay, legal compliance, and smoother payroll runs. With that in mind, this article explains:

- Why time tracking is key to accurate payroll

- How to keep payroll data clean

- Automated tools can prevent disputes

- How your business can save time

You will also learn what the 7-minute rule is and if it is legal to use. Finally, you will learn how modern mobile tools help you stay compliant without adding more work.

Why Time Tracking Is Essential for Accurate Payroll

To begin with, payroll cannot be right if the hours going into it are wrong. For instance, if a worker clocks in ten minutes early every day but a supervisor rounds it up to the nearest quarter hour, you might pay for nearly an extra hour of labor each week. In other cases, missing break time can trigger penalty pay in states like California.

The Fair Labor Standards Act (FLSA) makes accurate recordkeeping a federal requirement. Employers must track the hours each person works and the pay for every period.

Many small companies still depend on spreadsheets or sign-in sheets. These methods often lead to payroll errors time tracking complaints because there is no automatic way to check accuracy.

For example, the owner of Homecare Your Way, Suzana Sukunda, once collected handwritten timesheets from caregivers working in different homes. She spent hours each week verifying entries. After moving to ezClocker’s mobile app, their team clocked in from their phones, and she immediately saw which caregivers were on duty and for how long. Payroll preparation dropped from hours to minutes, and pay disputes nearly disappeared.

Another example is MDX Medical Center . They verified timesheets manually, which often delayed payroll. After adopting ezClocker, manager April Mills reviewed automated reports that summarized workers’ hours in seconds instead of hours. Also, in the past, some workers would clock in on their way to the office. Though the time increments were small, it was still costly. “Those 15 minutes may not seem like much, but they add up,” April says. Now that has stopped.

Accurate time tracking for payroll ensures that every paycheck reflects real hours worked. It builds trust with your team and keeps the business aligned with state and federal pay laws.

How to Ensure Accuracy When Processing Payroll

In many situations, businesses do not intend to make payroll errors time tracking. The trouble begins when no clear workflow exists to catch small errors before payday. Creating a consistent process keeps everyone aligned.

1. Write clear time policies. Your staff must know exactly when to clock in, what counts as paid time, and when breaks begin and end. Posting written rules in a breakroom and employee handbook helps everyone follow the same process.

2. Use automated time tracking. Manual entry often introduces human error. Automated systems record time, location, and job type instantly. ezClocker’s GPS mobile app gives managers visibility into when and where employees clock in. For example, when they clock in or out using ezClocker the app captures the GPS location of the employees. You can view the GPS information on your phone or computer on an easy to view map screen. This ensures accountability and frees up your time to focus on your clients and business instead of monitoring your team.

3. Audit before processing payroll. Review all time records before exporting them to your payroll service. Run reports and look for missed punches, unapproved overtime, or incomplete shifts.

4. Verify before exporting. Once time entries are confirmed, cross-check the total hours and pay codes. This step prevents underpayment or duplicate entries. Automated time tracking systems make everything easier.

5. Keep edit logs and records. The Department of Labor requires that employers maintain accurate hour and wage data for at least three years. Keeping a clear edit history protects your business if a question arises. Automated tools record who changed what and when, giving you an audit trail that paper files cannot provide.

When each of these steps becomes part of your routine, payroll runs faster, cleaner, and with fewer disputes.

Need an Employee Time Tracking App?

The Broader Benefits of Accurate Time Tracking

Precise time tracking goes far beyond getting paychecks right. It creates a clearer picture of how your team uses its time and where money flows.

Lower labor costs. When hours are tracked, managers can spot overtime before it happens. They can shift schedules or reassign tasks instead of paying unexpected premiums.

Better scheduling. Consistent time data shows trends, such as which shifts need more staff or which days are slower. This allows small businesses to schedule smarter and reduce idle time.

Improved compliance. Time and attendance compliance includes accurate overtime, proper break tracking, and honest recordkeeping. Automated systems prevent accidental violations that could lead to fines or back pay orders. The FLSA also notes that employers must maintain clear records of daily and weekly hours.

Employee confidence. When workers know their hours are recorded correctly, they trust payroll results. That trust improves retention and reduces the number of disputes HR must resolve.

Reduced administrative work. Manual data entry consumes valuable hours each week. Automated time tracking for payroll eliminates retyping numbers into a spreadsheet. Most tools export hours directly to payroll systems, cutting prep time dramatically.

Business scalability. As a company grows, more locations, roles, and shifts create complexity. Automated time tracking keeps operations simple by applying the same rules everywhere. This consistency keeps payroll accurate whether you have five workers or fifty. Over time, these benefits add up to real savings and smoother operations.

The 7-Minute Rule for Payroll

Many small business owners have heard of the 7-minute rule but are not sure how it works. The rule comes from federal pay laws that let employers round time up or down up to 15 minutes.

Here is the basic idea. If an employee clocks in within seven minutes before or after a quarter hour, the time can be rounded to the nearest fifteen-minute mark. For instance, clocking in at 8:07 rounds back to 8:00. Clocking in at 8:08 rounds forward to 8:15.

The rule is legal when it averages out over time. It must also be used the same way for everyone. If it is not applied evenly, it can lead to pay mistakes.

This small change might not sound big, but it adds up fast. Imagine an employee who clocks in six minutes late every day. If those minutes are rounded back, you may pay for many hours not worked. Over a year, that could equal an entire week of extra pay. You must be consistent.

Automated time tracking tools remove this gray area. They record the exact start and end times and apply rounding rules the same way for all staff. Managers can spot who clocks close to the limit and talk with them to fix habits. Fair rounding builds trust and prevents disputes.

Always check your state laws. States like California, Illinois, New York, Colorado, Nevada, and Oregon each have their own laws about time rounding.

Common Payroll Error Scenarios

Payroll mistakes tend to follow predictable patterns. Understanding them helps prevent costly corrections.

Missed punches. Employees forget to clock in or out, forcing managers to guess hours.

Buddy punching. One worker clocks in for another. GPS verification can prevent this by recording the employee’s location at the time of punch.

Multiple pay rates. Some workers switch between roles that have different pay rates. Without tracking job codes, payroll might pay the wrong rate.

Break and meal errors. Missed breaks can trigger penalties in states with strict labor laws.

Travel or on-call time. The FLSA often requires that travel between job sites or on-call hours be paid. A time tracking system can ensure those hours are captured correctly.

Spread of hours laws. States such as New York require premium pay when shifts extend over a long span of the day.

Each of these situations ties back to one truth. The more accurate your time tracking is, the fewer surprises appear at payroll.

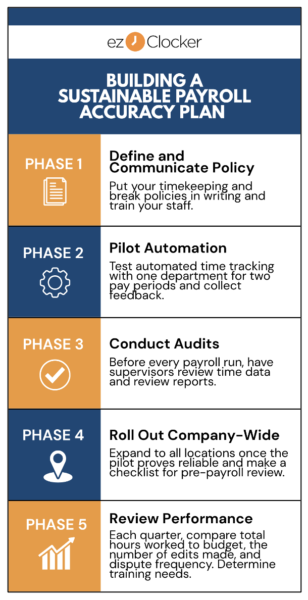

Building a Sustainable Payroll Accuracy Plan

Once a company understands where errors come from, the next step is building a system that keeps them away. A clear adoption plan makes it easier to implement change without overwhelming staff.

Phase 1 – Define and communicate policy. Put your timekeeping and break policies in writing. Train your staff on how and when to record hours. Make sure managers follow the same rules.

Phase 2 – Pilot automation. Test automated time tracking with one department for two pay periods. Collect feedback about what works and what needs clarification.

Phase 3 – Conduct audits. Before every payroll run, have supervisors review time data. Review reports to document any adjustments and confirm that totals match expected schedules.

Phase 4 – Roll out company-wide. Expand to all locations once the pilot proves reliable. Keep a checklist for pre-payroll review to catch small errors early.

Phase 5 – Review performance. Each quarter, compare total hours worked to budget, the number of edits made, and dispute frequency. Over time, the data will show where your process succeeds and where additional training may help.

Following these phases turns time tracking from a task into a dependable business process.

Compliance and Record keeping Best Practices

Strong recordkeeping supports accuracy, compliance, and trust.

Modern time tracking software simplifies that obligation by storing digital logs automatically. You can view who changed a punch, when it happened, and why. This information not only supports payroll accuracy but also protects the business in the event of an audit.

Storing records securely and consistently shows your team that management values fairness and transparency. When payroll questions arise, accurate records provide quick answers instead of frustration.

Final Thoughts

On the whole, payroll errors time tracking issues stem from poor data collection, not poor intent. When you fix the way hours are tracked, you fix most payroll problems at the source. Clear policies, simple tools, and consistent audits keep paychecks accurate and disputes low.

Small business owners who use ezClocker report that automated time tracking cuts their payroll prep time each week.

Now is a good time to review your process. Ask yourself how many hours are still entered by hand and how often you adjust time cards after the fact. If those numbers are high, automation can make a difference.

Set aside one hour this week to review how your company records time. Look for missing punches, rounding errors, or last-minute edits. Then choose a reliable system to close those gaps. When you start tracking time accurately, payroll errors fade and trust grows.